Introduction

Life insurance is a crucial aspect of financial planning, offering peace of mind and financial security to your loved ones in the event of your untimely demise. While contemplating life insurance may seem daunting, understanding its nuances can help you make informed decisions that ensure the well-being of your family. This comprehensive guide will delve into the various facets of life insurance, including its importance, types, benefits, and how to choose the best policy for your needs.

Section 1: Understanding Life Insurance

1.1 What is Life Insurance?

Life insurance is a contract between an individual and an insurance company, where the insurer promises to pay a designated beneficiary a sum of money upon the death of the insured person. This financial safety net can cover expenses like funeral costs, debts, and living expenses, providing financial stability for your dependents.

1.2 The Importance of Life Insurance

Life insurance is a crucial financial tool that provides protection and peace of mind for you and your loved ones. Here’s a detailed article outlining the importance of life insurance:

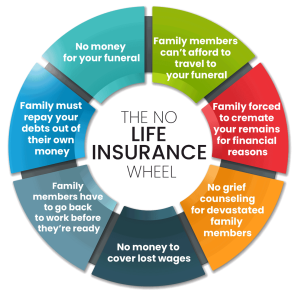

1. Financial Security for Loved Ones: Life insurance serves as a financial safety net for your family in the event of your death. It provides your beneficiaries with a tax-free lump sum payment, known as the death benefit, which can help replace lost income, cover living expenses, pay off debts, and fund future financial goals such as education or retirement.

2. Income Replacement: If you’re the primary breadwinner in your family, your death could leave your dependents without a source of income. Life insurance ensures that your loved ones can maintain their standard of living and meet their ongoing financial needs, such as mortgage or rent payments, utility bills, groceries, and other essentials.

3. Debt Repayment: Many people have outstanding debts such as mortgages, car loans, credit card balances, or student loans. Life insurance proceeds can be used to pay off these debts, relieving your family of financial burdens and preventing them from inheriting your liabilities.

4. Funeral and Final Expenses: Funeral and burial expenses can be significant, often costing thousands of dollars. Life insurance can cover these expenses, sparing your loved ones from having to bear the financial burden during an already difficult time.

5. Estate Planning: Life insurance plays a crucial role in estate planning by providing liquidity to cover estate taxes, probate costs, and other expenses associated with the transfer of assets to heirs. It can help ensure that your estate is settled efficiently and that your beneficiaries receive their inheritances as intended.

6. Business Continuity: For business owners, life insurance can be used to fund buy-sell agreements, key person insurance, or business succession plans. In the event of the death of a business partner or key employee, life insurance proceeds can help the business survive financially and facilitate a smooth transition of ownership or management.

7. Peace of Mind: Knowing that you have life insurance coverage in place can provide you with peace of mind, knowing that your loved ones will be financially protected no matter what happens. It offers reassurance that your family will be taken care of and can maintain their quality of life, even if you’re no longer there to provide for them.

8. Affordability and Accessibility: Life insurance is generally affordable, especially when you’re young and healthy. Term life insurance, in particular, offers straightforward coverage for a specified period at a relatively low cost. Additionally, many employers offer group life insurance as part of their employee benefits package, making coverage easily accessible.

In conclusion, life insurance is an essential financial tool that provides invaluable protection and security for you and your loved ones. By ensuring that your family is financially taken care of in the event of your death, life insurance offers peace of mind and helps you plan for the unexpected. It’s a proactive step toward safeguarding your family’s financial future and ensuring that they can thrive even in your absence.

Life insurance serves as a critical component of a comprehensive financial plan. It ensures that your loved ones are not left in a financial lurch if you pass away unexpectedly. This protection can help maintain their standard of living, pay off outstanding debts, fund educational expenses, and cover everyday living costs.

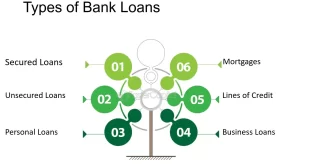

Section 2: Types of Life Insurance

2.1 Term Life Insurance

Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. If the insured person dies within the term, the policy pays out the death benefit to the beneficiaries. Term life insurance is often the most affordable option, making it popular among young families and individuals with temporary financial obligations.

- Level Term: The death benefit remains the same throughout the policy term.

- Decreasing Term: The death benefit decreases over the term, often used for mortgage protection.

2.2 Whole Life Insurance

Whole life insurance provides lifelong coverage, combining a death benefit with a cash value component that grows over time. Premiums are generally higher than term policies, but the policyholder can borrow against or withdraw from the cash value during their lifetime. Whole life insurance is ideal for those seeking lifelong coverage and a savings component.

2.3 Universal Life Insurance

Universal life insurance offers more flexibility than whole life insurance. Policyholders can adjust their premiums and death benefits within certain limits. The policy also accumulates cash value, which earns interest based on market rates or a fixed interest rate. Universal life insurance is suitable for those who want lifelong coverage with flexible premium and death benefit options.

2.4 Variable Life Insurance

Variable life insurance allows policyholders to invest the cash value in various investment options like stocks, bonds, and mutual funds. The policy’s cash value and death benefit can fluctuate based on the performance of these investments. This type of policy is for those comfortable with investment risks and looking for potential growth in their policy’s value.

2.5 Indexed Universal Life Insurance

Indexed universal life insurance (IUL) combines features of universal life insurance with the potential for cash value growth tied to a stock market index. Policyholders can benefit from market gains while having protection against market losses. IUL is suitable for those seeking flexible premiums and death benefits with growth potential linked to market performance.

Section 3: Benefits of Life Insurance

3.1 Financial Security

The primary benefit of life insurance is providing financial security to your beneficiaries. The death benefit can replace lost income, allowing your family to maintain their lifestyle and meet financial obligations.

3.2 Debt Repayment

Life insurance can help cover outstanding debts such as mortgages, car loans, and credit card debt, preventing your loved ones from shouldering these financial burdens after your death.

3.3 Funeral and Burial Costs

Funeral and burial costs can be significant. Life insurance ensures that these expenses are covered, alleviating the financial stress on your family during a difficult time.

3.4 Estate Planning

Life insurance can be a useful tool in estate planning, providing liquidity to cover estate taxes and ensuring that your heirs receive their inheritance without financial strain.

3.5 Cash Value Component

Permanent life insurance policies, such as whole life and universal life, accumulate cash value over time. This cash value can be accessed during your lifetime through loans or withdrawals, providing a source of funds for emergencies, education, or retirement.

Section 4: How to Choose the Right Life Insurance Policy

4.1 Assess Your Needs

Determine how much coverage you need by evaluating your financial obligations, such as mortgage payments, education costs, and daily living expenses. Consider your income replacement needs and any other financial goals.

4.2 Compare Different Policies

Research and compare different types of life insurance policies to find one that fits your needs and budget. Consider factors such as the length of coverage, premium costs, and potential cash value accumulation.

4.3 Evaluate the Insurer’s Financial Strength

Choose a reputable insurance company with a strong financial rating. This ensures that the company will be able to pay out claims when needed. Check ratings from agencies like A.M. Best, Standard & Poor’s, and Moody’s.

4.4 Review Policy Features

Look for policies that offer features and riders that meet your specific needs. Common riders include:

- Accelerated Death Benefit: Allows you to access a portion of the death benefit if diagnosed with a terminal illness.

- Waiver of Premium: Waives premium payments if you become disabled.

- Guaranteed Insurability: Allows you to purchase additional coverage without undergoing a medical exam.

4.5 Seek Professional Advice

Consult with a financial advisor or insurance agent to get personalized recommendations based on your financial situation and goals. They can help you understand complex policy details and find the best coverage options.

Section 5: Common Myths and Misconceptions About Life Insurance

5.1 “Life Insurance is Too Expensive”

Many people overestimate the cost of life insurance. Term life insurance, in particular, is often affordable, especially for young and healthy individuals. It’s important to get quotes and compare options to find a policy that fits your budget.

5.2 “I Don’t Need Life Insurance Because I’m Single”

Even if you’re single, life insurance can cover debts, funeral expenses, and provide for any dependents you may have, such as aging parents or siblings with special needs.

5.3 “Employer-Provided Life Insurance is Sufficient”

Employer-provided life insurance is a great benefit, but it often provides limited coverage that may not be sufficient to meet your family’s financial needs. Additionally, coverage usually ends if you leave your job, so having a personal policy can provide more comprehensive and lasting protection.

5.4 “Life Insurance is Only for Older People”

Life insurance is important for people of all ages. Purchasing a policy when you’re young and healthy can result in lower premiums. It also ensures financial protection for your loved ones if something unexpected happens.

5.5 “All Life Insurance Policies are the Same”

Life insurance policies vary widely in terms of coverage, cost, and features. It’s crucial to understand the differences between term, whole, universal, and other types of life insurance to choose the one that best meets your needs.

Section 6: Applying for Life Insurance

6.1 Gather Necessary Information

Before applying for life insurance, gather essential information, including personal identification, medical history, financial details, and beneficiary information.

6.2 Undergo a Medical Exam

Most life insurance applications require a medical exam to assess your health. The exam typically includes measurements of height, weight, blood pressure, and blood and urine tests. Some policies, like simplified issue or guaranteed issue life insurance, do not require a medical exam but may have higher premiums.

6.3 Review and Sign the Policy

Once approved, review the policy documents carefully. Ensure all details are correct, understand the terms and conditions, and clarify any doubts with your insurance agent before signing.

6.4 Keep Your Policy Updated

Life changes, such as marriage, having children, or significant income changes, may necessitate adjustments to your life insurance policy. Regularly review and update your policy to ensure it meets your current needs.

Conclusion

Life insurance is a vital part of a sound financial plan, providing security and peace of mind for you and your loved ones. By understanding the different types of policies, assessing your needs, and making informed decisions, you can choose the right coverage to protect your family’s future. Whether it’s covering final expenses, paying off debts, or providing for your family’s financial stability, life insurance ensures that your legacy is one of care and protection. Start exploring your options today and secure a brighter tomorrow for those you love.